Get started now!

Coastal to Rocket City Mortgages

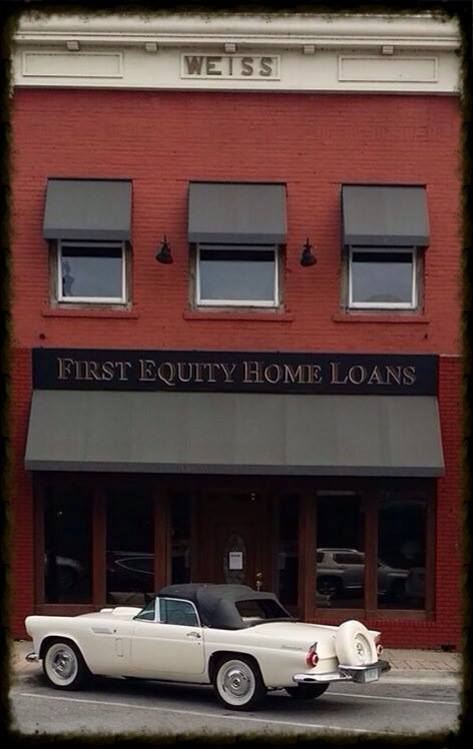

Navigate Alabama's Golden Era: Coastal calm for golden years, rocket-fueled funding for Space Force innovators, and solid capital for industrial trailblazers. Skip the outsiders—our local Alabama pros deliver faster, smarter closes. Get your custom quote and blast off!

PP

Calculate how much your monthly mortgage payment could be among tradition loans. Non-QM loans do not require mortgage insurance but only go to 90 percent max loan to value. Rates aren't always higher, but you can expect higher rates with higher LTV and lower credit scores on NON-QM programs. We look for a min. 620 on all Non-QM loans. Some tradition programs accept 580 scores. Simple "Risk-Based" make sense pricing. Restrictions sometimes apply. Custom Quotes from MtgQuote Pro's are the best way forward.!

* Results are hypothetical and may not be accurate. This is not a commitment to lend nor a preapproval. Consult our Alabama Mortgage Professional for full details. Fast custom quotes are our specialty. Fast Closings are our normal.

See All Mortgage Calculators

No down payment, no PMI—tailored rates for Alabama vets & active duty. Build equity fast with MTGQuote's local know-how.

$766K+ for Gulf Coast estates or Birmingham mansions—flexible underwriting, competitive edges. No sweat on big buys

3% down, fixed rates for refinances or moves—Alabama's go-to for steady, no-gimmick home loans.

3.5% down, forgiving credit—ideal for first-timers in Montgomery, Hokes Bluff, or Mobile. We handle the details.

.

Zero down, no PMI for eligible homes—from farms to small towns. Fuel your Southern roots with us. |

Assets, bank statements, or alt-income? We craft custom fits beyond the box—ideal for unique financial stories

Qualify with 12-24 months of deposits—no tax returns needed. Perfect for Huntsville entrepreneurs & freelancers.

Tailored for freelancers & owners—use 1099s, profits, or deposits to qualify. No big-bank barriers here.

Our MtgQuote.com site guides you through your mortgage options and connects you directly to Alabama Mortgage Professional for personalized precision service you can trust. View our Relocation Tools for buyers moving to our state and locals considering other towns. Everything from GDP figures, Median Home Prices, Vacancy rates, School report cards and comparison tools. Dig deep into your next move. We use these same tools and our Realtor Mortgage Partner Network to help us serve our customers Better!

Simplifying mortgage details with our great network saves time and pleases clients!

Don't navigate alone—our vetted Realtor Partners know the ins and outs, from Huntsville's tech enclaves to Gulf Coast gems and all points between. With Vetted experience and superior client satisfaction, they'll match you to your dream home fast. Click 'Find Your Realtor' now and get a free consultation tailored to your zip code—your move starts here!

Sign up free for mortgage rate alerts in Alabama—get texts, emails, or calls when rates hit your target (now at 6.30% for 30-yr fixed as of 10/9/25). Every drop means we can save more money for our Alabama clients. Save on Refinancing in Birmingham, Huntsville... Statewide. Quick form: Enter your details & desired rate today!

Alabama Mortgages: From Gulf Breezes to Rocket Heights – Swift, Southern, Unshakable

Find out when an ARM mortgage might be better than Fixed Rate Mortgage

Find out if refinancing is right for you.

Learn about home affordability factors with examples nationwide.

Buying a home doesn't have to be stressful. We make your dream home a reality with competitive rates and dedicated guidance... making buying/refinancing your home a breeze.

By providing your phone number and/or email address you agree to receive updates, offers, and other promotional and marketing communications from First Equity Home Loan, Inc. We detest robo-automated calls and spam and never share our customer data unless authorized in conjunction with your mortgage request.

Monday - Friday 9 a.m. - 5 p.m.

Saturday - 9 a.m. - 5 p.m.

Online 24/7